How CryptoWeeksBloomberg is Shaping the Future of Cryptocurrency Insights

The world of CryptoWeeksBloomberg has seen an exponential rise in both popularity and complexity over the past decade. As digital assets continue to dominate headlines and markets, the need for accurate, timely, and expert-driven insights has never been greater. One source that’s been pivotal in bridging the information gap is CryptoWeeksBloomberg, a specialized report provided by the renowned financial media company, Bloomberg.

CryptoWeeksBloomberg serves as a comprehensive guide to the ever-evolving cryptocurrency market. The reports provide in-depth analysis, weekly summaries, and predictions that help investors, traders, and enthusiasts stay ahead of the curve. In this article, we’ll explore how CryptoWeeksBloomberg is shaping the future of cryptocurrency insights and why it’s a must-have resource for anyone involved in the crypto ecosystem.

What is CryptoWeeksBloomberg?

CryptoWeeksBloomberg is a series of weekly reports and analyses that cover the most significant trends, developments, and insights in the cryptocurrency space. The reports are curated by Bloomberg’s team of experts, who have access to a vast network of data and resources, ensuring that the information provided is accurate, relevant, and timely.

Each edition of CryptoWeeksBloomberg typically includes:

- Market Overview: A summary of the latest price trends for top cryptocurrencies like Bitcoin, Ethereum, and emerging altcoins.

- Regulatory Updates: Key changes in government regulations and their impact on the market.

- Investor Sentiment: Insights into the mood of the market and potential opportunities or risks.

- Technological Developments: Updates on blockchain advancements and other technological shifts affecting the crypto landscape.

- Expert Opinions: Interviews and analyses from industry leaders, developers, and investors.

Given the complexity and fast-moving nature of the cryptocurrency market, CryptoWeeksBloomberg has become an invaluable tool for anyone looking to stay informed.

Why CryptoWeeksBloomberg is Important for Investors

1. Providing Timely Market Insights

Cryptocurrency markets are known for their volatility, with prices fluctuating in response to a wide array of factors including market sentiment, technological breakthroughs, and even regulatory changes. For investors, staying on top of these shifts can be the difference between making a profitable trade and incurring significant losses.

CryptoWeeksBloomberg offers weekly updates on market movements, helping investors make well-informed decisions. These reports track price patterns, highlight emerging trends, and identify potential risks or opportunities. This real-time data is essential for both short-term traders and long-term investors who wish to navigate the market with confidence.

2. Expert Analysis of Cryptocurrency Trends

Unlike many other sources of cryptocurrency news, CryptoWeeksBloomberg provides expert analysis that goes beyond surface-level reporting. Bloomberg’s analysts are seasoned professionals with years of experience in financial markets, providing a level of depth and reliability that is often lacking in other crypto-related content.

Each report is designed to offer actionable insights, backed by research and analysis, which can help investors refine their strategies. Whether it’s understanding how macroeconomic trends are influencing crypto prices or assessing the long-term viability of specific tokens, CryptoWeeksBloomberg delivers critical insights that can guide investment decisions.

3. Understanding the Regulatory Landscape

One of the most significant factors influencing the cryptocurrency market is the evolving regulatory landscape. Countries around the world are grappling with how to regulate digital assets, with some taking a proactive approach while others remain cautious or even hostile.

CryptoWeeksBloomberg provides regular updates on regulatory changes that could impact the market. For example, it may cover new government regulations on digital currencies, tax policies, or central bank digital currency (CBDC) developments. Understanding these regulatory shifts is crucial for investors who want to avoid legal pitfalls and capitalize on regulatory changes before they hit the mainstream.

4. Spotting Emerging Cryptocurrencies and Technologies

While Bitcoin and Ethereum remain the dominant forces in the crypto world, numerous emerging cryptocurrencies and blockchain technologies could offer substantial returns. However, identifying these opportunities before they become widely recognized is often challenging.

CryptoWeeksBloomberg often highlights new cryptocurrencies, token offerings, and blockchain innovations that are worth paying attention to. By covering developments from emerging projects and early-stage innovations, CryptoWeeksBloomberg allows investors to stay ahead of the curve and potentially identify high-growth opportunities early on.

5. Comprehensive Data and Tools

CryptoWeeksBloomberg provides more than just a written analysis. It includes a range of data tools, charts, and metrics that enable investors to track performance, analyze trends, and evaluate different cryptocurrencies. With access to Bloomberg’s proprietary financial data and tools, readers can take a more data-driven approach to their crypto investments.

The Future of CryptoWeeksBloomberg in Cryptocurrency Research

The cryptocurrency market is still in its early stages, with many new developments expected in the coming years. As the market matures, the need for comprehensive, expert-driven analysis will only grow. CryptoWeeksBloomberg is poised to play a significant role in shaping the future of cryptocurrency research.

- Integration with AI and Machine Learning: As artificial intelligence and machine learning technologies advance, it’s likely that future CryptoWeeksBloomberg reports will incorporate more predictive analytics and AI-driven insights. This could provide even more accurate forecasts of market movements and trends.

- Enhanced User Interactivity: With advancements in data visualization and user interfaces, CryptoWeeksBloomberg may offer more interactive tools, allowing readers to dive deeper into specific trends or markets that interest them.

- Expansion to Global Markets: As the global cryptocurrency market grows, we may see CryptoWeeksBloomberg expand its coverage to more regions, offering localized insights for investors in different parts of the world.

How CryptoWeeksBloomberg Impacts the Crypto Ecosystem

1. Fostering a More Educated Investor Base

One of the most significant impacts of CryptoWeeksBloomberg is its role in educating investors. Many newcomers to the crypto space often struggle with the technicalities of blockchain, the nuances of market trends, and the regulatory challenges they face. Through well-researched reports and in-depth analyses, CryptoWeeksBloomberg helps bridge this knowledge gap.

2. Encouraging Responsible Investment Practices

By providing a clear picture of the risks and rewards associated with various cryptocurrencies, CryptoWeeksBloomberg helps investors make informed decisions. This can lead to a more sustainable and responsible approach to crypto investing, reducing the likelihood of speculative bubbles or mass panic during market downturns.

3. Promoting Transparency in the Crypto Space

CryptoWeeksBloomberg contributes to the broader trend of increasing transparency in the cryptocurrency industry. By publishing comprehensive reports on market dynamics, technological developments, and regulatory updates, it helps foster trust and accountability within the ecosystem. As transparency increases, more institutional investors are likely to enter the space, further legitimizing the market.

Conclusion

CryptoWeeksBloomberg is not just a news source; it’s a powerful tool that shapes the future of cryptocurrency insights. By offering timely market updates, expert analysis, and insights into regulatory changes and emerging technologies, it helps investors and enthusiasts navigate the complex world of digital currencies. As the cryptocurrency market continues to evolve, reports like CryptoWeeksBloomberg will play a crucial role in fostering educated, responsible, and well-informed investors, driving the market toward greater maturity.

FAQs About CryptoWeeksBloomberg

1. What is CryptoWeeksBloomberg?

CryptoWeeksBloomberg is a weekly report from Bloomberg that provides expert analysis, market trends, regulatory updates, and insights into the cryptocurrency market. It’s designed for investors, traders, and enthusiasts to stay informed about the rapidly changing crypto landscape.

2. How does CryptoWeeksBloomberg benefit investors?

CryptoWeeksBloomberg benefits investors by providing timely updates, expert opinions, and data-driven insights that help them make informed investment decisions. It tracks price trends, emerging cryptocurrencies, and regulatory changes, helping investors spot opportunities and mitigate risks.

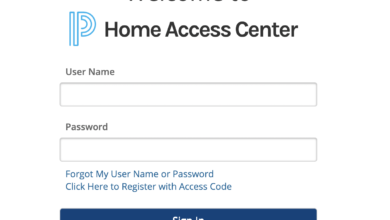

3. How can I access CryptoWeeksBloomberg?

CryptoWeeksBloomberg is available through Bloomberg’s platform, typically as part of its premium subscription services. It may also be accessible through other media channels that syndicate Bloomberg’s cryptocurrency reports.

4. Does CryptoWeeksBloomberg cover altcoins or only Bitcoin?

Yes, CryptoWeeksBloomberg covers a wide range of cryptocurrencies, including Bitcoin, Ethereum, and various altcoins. It provides insights into emerging tokens and new blockchain projects as well.

5. Is CryptoWeeksBloomberg useful for beginners in cryptocurrency?

Absolutely. CryptoWeeksBloomberg provides both basic and advanced insights, making it suitable for newcomers as well as seasoned investors. Its expert analysis helps break down complex topics, making it easier for beginners to understand the market and make educated investment decisions.

You May Also Read: https://bigbestwire.com/nsid-login/